You know it’s a heavy volume day when even Google can’t handle it:

Your message could not be posted to the DOW JONES INDUSTRIAL AVERAGE INDEX group because there have been too many messages posted to the group recently.

O brave new quantum world!

You know it’s a heavy volume day when even Google can’t handle it:

Your message could not be posted to the DOW JONES INDUSTRIAL AVERAGE INDEX group because there have been too many messages posted to the group recently.

Fear

Google’s view of capitulation

Irrationality?

Anyone seen any old men with canes yet?

Crisis per capita winner? Iceland. Will the last one leaving Reykjavík please tear up that recipe for Súrsaðir hrútspungar?

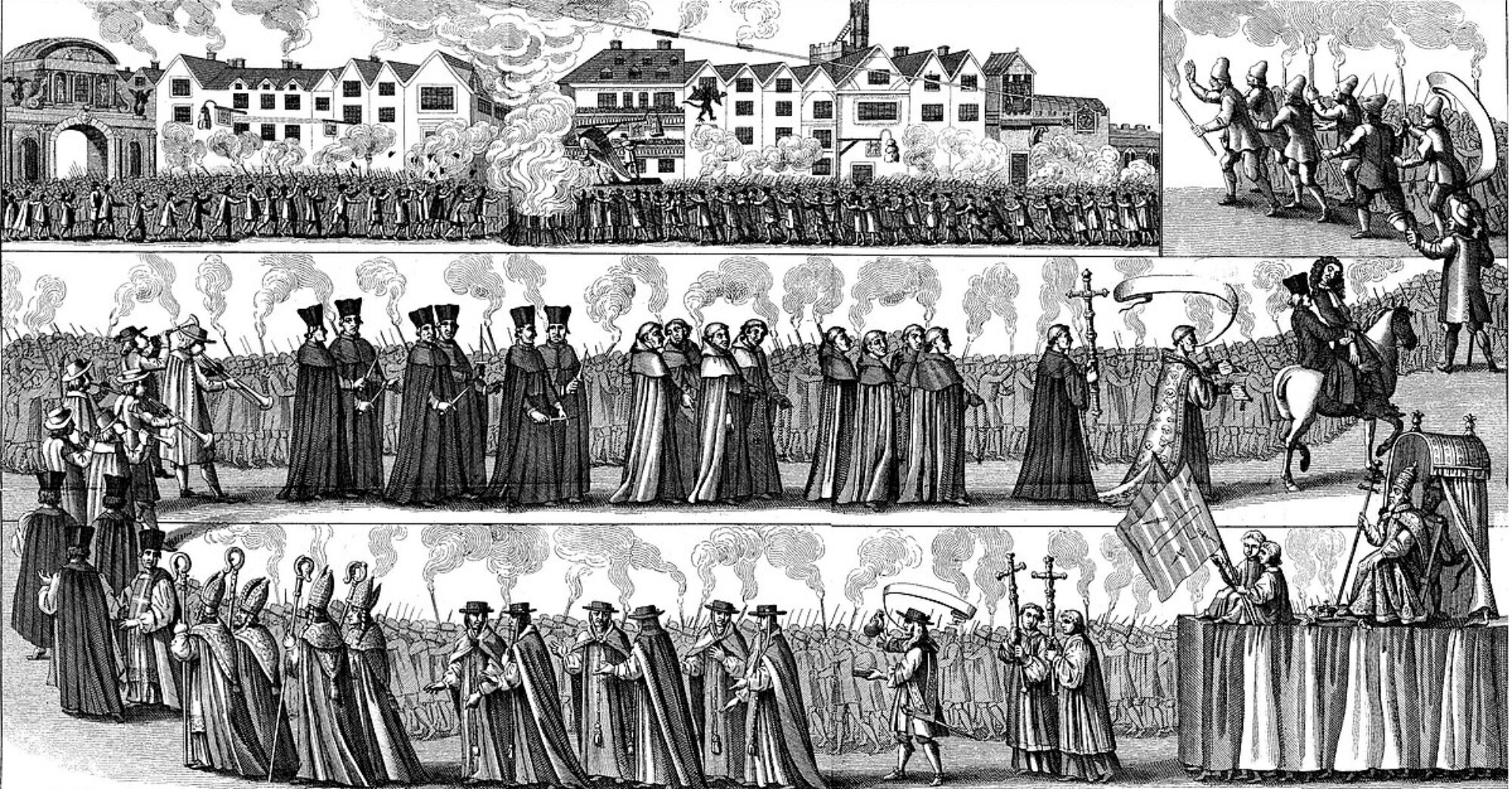

Panics 1812, 1837, 1869, 1873, 1882, 1884, 1896, 1901, 1907,1937, 1973, 1987, 1989, 1992, 1997, 2001. Add 2008.

Just over a hundred years ago

Another hundred year reference: the Cub’s ticket market.

Let’s blame Van Buren:

IANAE (that’s I am not a person with severe physics envy but who is compensated for this fact by earning a higher salary than a physicist), but I do not understand Brad DeLong:

Traders! Read the second page of the statistical release before you press the button!

Meredith Beechey…and Jonathan Wright have details:FRB: FEDS paper 2007-5: “Rounding and the Impact of News: A Simple Test of Market Rationality”:

Abstract: Certain prominent scheduled macroeconomic news releases contain a rounded number on the first page of the release that is widely cited by newswires and the press, and a more precise number in the text of the release. The whole release comes out at once. We propose a simple test of whether markets are paying attention to the rounded or unrounded numbers by studying the high-frequency market reaction to such news announcements. In the case of inflation releases, we find evidence that markets systematically ignore some of the information in the unrounded number. This is most pronounced for core CPI, a prominent release for which the rounding in the headline number is large relative to the information content of the release.

If the market is only reacting to the rounded number, why should a trader pay attention to the unrounded number? Is this just a case of sipping at the cooler of the efficient market hypothesis (i.e. surely the market will eventually revert to the unrounded number.) Or am I missing something?